Over the years, we have noticed that preferred shares, often held as a substitute for bonds, are popular investments for foundations and charities. We will explain what preferred shares are, what role they play in a portfolio and why they are widely held – arguably far more widely held than they should be.

What are preferred shares?

Preferred shares are often thought of as a hybrid of stocks and bonds. Although preferred shares sit above common shares in the capital structure of a corporation, they sit below bonds and other debt obligations. In the event of bankruptcy, bondholders are paid before shareholders, while in the event of financial difficulty that causes a corporation to cut its dividend, preferred shareholders have first claim on dividends. Most preferred shares in Canada are rate-reset preferreds, with dividends set at a premium to Canada five-year bonds. Given the hybrid role of preferreds, one might expect to see returns that are not as defensive as bonds but not as aggressive as stocks. Let’s see if this is the case.

What role do they play?

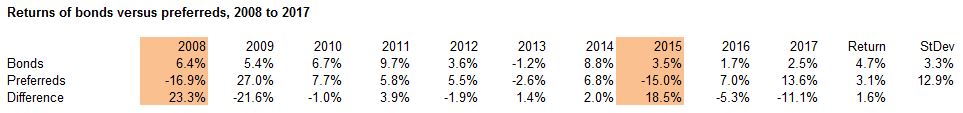

Below we see the performance of bonds (FTSE Canada Universe Bond Index) versus preferreds (S&P TSX Preferred Share Index), in the 10-year period from 2008 to 2017:

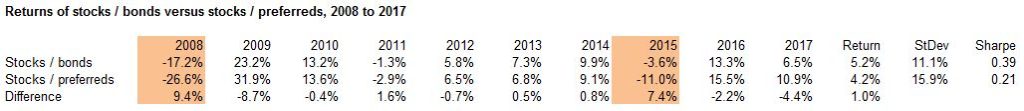

Two years stand out. In 2008, during the global financial crisis, bonds gained 6.4% while preferreds lost 16.9% (difference of 23.3%). In 2015, a year of moderate losses for Canadian stocks, bonds gained 3.5%, while preferreds lost 15% (difference of 18.5%). These two years highlight the fundamental problem of preferreds – they do not protect against losses in the stock market. In addition, the returns of preferreds compared to bonds were 1.6% lower and their volatility almost four times higher. This picture of lower return and higher risk becomes even clearer when we look at a benchmark portfolio of 60% stocks (S&P TSX Capped Composite) and 40% bonds. The first portfolio actually holds bonds (FTSE Canada Universe Bond Index), while the second portfolio holds preferreds instead of bonds (S&P TSX Preferred Share Index). Again, this is for the 10-year period from 2008 to 2017:

It is one thing to incur losses from stocks during a bad year like 2008. This is simply part of earning the equity risk premium – the higher expected return that comes from investing in stocks. It is quite another thing to see large losses from the “bond” portion of the portfolio at the same time. A loss of 17% is perhaps manageable for some institutions but a loss of 27% is likely to come with some behavioural cost, such as panic-selling, missing out on gains when the market recovers and losing confidence in a long-term investment plan.

Economics explains a good part of the reason why preferreds perform poorly when the stock market declines. During a stock market crash, the economy often falls into recession. When this happens, the Bank of Canada generally cuts interest rates, to encourage businesses to invest and consumers to spend. Yet preferreds, because of their rate-reset structure, work in the other direction, typically performing well when rates rise (in expectation of higher dividends) and performing poorly when rates fall (in expectation of lower dividends). Investors who want short-term stability from bonds should be uncomfortable with bond substitutes like preferreds that are economically structured to perform poorly during a stock market crash.

Why are they widely held?

Part of the reason why preferreds are widely held is the “reach for yield” in a decade of low interest rates. Since endowments and foundations often hold about half of their assets in bonds and cash, returns as low as 1% for cash start to chafe after a while and encourage investors to take on more risk as they seek higher yield. The reach for yield can take many forms, including not just preferred shares but also common shares in utilities, pipelines and consumer staples – sectors that are considered by some (unwisely in our view) as bond substitutes. Yet while part of the reason for the popularity of preferreds has to do with demand from investors, another part has to do with supply from financial intermediaries, especially big banks. In Canada, preferred shares are often listed in an Initial Public Offering for $25. This is after a fee of $0.75 (or about 3% of proceeds) paid to the underwriting banks. In situations where a bank is advising charities or foundations, the bank advisor is typically paid about half of the 3% fee for placing the preferreds with the institution. Often the bank advisor is only held to a “suitability” standard rather than a fiduciary standard. This enables the advisor to recommend preferreds as a “suitable” investment, even though it is far from clear that preferreds meet the best interests of institutions.

Implications

The current bull market for stocks has run for 10 years and in the next downturn it is unlikely that preferred shares would provide the same protection as high-quality bonds. For institutions that need to manage short-term market risk to maintain spending, we recommend replacing preferred shares with high-quality bonds. For institutions holding more than 10% of their portfolio in preferred shares, we suggest reflecting on how this has happened, given the association of preferred shares with lower returns, higher losses during stock market crashes and potential conflicts of interest from bank advisors.